Company reiterates full-year 2025 financial and operational guidance

DALLAS, April 23, 2025 — AT&T Inc. (NYSE: T) reported solid first-quarter results that again showcase its ability to grow the right way with high-quality, profitable 5G and fiber subscriber additions. The Company reiterates all 2025 full-year financial and operational guidance. Based on the reduction in net debt and the Company’s outlook, AT&T is operating within its net leverage target of net debt-to-adjusted EBITDA* in the 2.5x range and plans to commence share repurchases in the second quarter.

“Our business fundamentals remain strong, and we are uniquely positioned to win in this dynamic and competitive market,” said John Stankey, AT&T Chairman and CEO. “We are growing the right way as customers continue to choose AT&T Fiber and 5G wireless for connectivity they can rely on, guaranteed or we’ll make it right. The priorities we laid out at our 2024 Analyst & Investor Day have not changed, and we continue to operate our business to achieve the financial plan and capital returns we outlined in December.”

First-Quarter Consolidated Results

- Revenues of $30.6 billion

- Diluted EPS of $0.61 versus $0.47 a year ago; adjusted EPS* of $0.51 versus $0.48 a year ago

- Operating income of $5.8 billion; adjusted operating income* of $6.4 billion

- Net income of $4.7 billion; adjusted EBITDA* of $11.5 billion

- Cash from operating activities of $9.0 billion, versus $7.5 billion a year ago

- Capital expenditures of $4.3 billion; capital investment* of $4.5 billion

- Free cash flow* of $3.1 billion, versus $2.8 billion a year ago

First-Quarter Highlights

- 324,000 postpaid phone net adds with postpaid phone churn of 0.83%

- Mobility service revenues of $16.7 billion, up 4.1% year over year

- 261,000 AT&T Fiber net adds; 200,000, or more, net adds for 21 consecutive quarters

- Consumer fiber broadband revenues of $2.1 billion, up 19.0% year over year

- 29.5 million consumer and business locations passed with fiber

- More than 4 out of every 10 AT&T Fiber households now choose AT&T wireless1

Download First-Quarter Highlights document here.

2025 Outlook

For the full year, AT&T expects:

- Consolidated service revenue growth in the low-single-digit range.

- Mobility service revenue growth in the higher end of the 2% to 3% range.

- Consumer fiber broadband revenue growth in the mid-teens.

- Adjusted EBITDA* growth of 3% or better.

- Mobility EBITDA* growth in the higher end of the 3% to 4% range.

- Business Wireline EBITDA* to decline in the mid-teens range.

- Consumer Wireline EBITDA* growth in the high-single to low-double-digit range.

- Capital investment* in the $22 billion range.

- Free cash flow* of $16 billion+.

- Adjusted EPS* of $1.97 to $2.07.

Additionally, the Company continues to expect the sale of its entire 70% stake in DIRECTV to TPG to close in mid-2025.

Note: AT&T’s first-quarter earnings conference call will be webcast at 8:30 a.m. ET on Wednesday, April 23, 2025. The webcast and related materials, including financial highlights, will be available at investors.att.com.

Consolidated Financial Results

- Revenues for the first quarter totaled $30.6 billion versus $30.0 billion in the year-ago quarter, up 2.0%. This was due to higher Mobility and Consumer Wireline revenues, partially offset by declines in Business Wireline and Mexico, which included unfavorable foreign exchange impacts.

- Operating expenses were $24.9 billion versus $24.2 billion in the year-ago quarter. Operating expenses increased primarily due to higher equipment costs associated with higher wireless equipment revenues and higher restructuring costs. Additionally, depreciation increased from our continued fiber investment and network upgrades, partially offset by lower impacts from our Open RAN network modernization efforts. These increases were partially offset by expense declines from continued transformation efforts and lower network related costs, which included lower negotiated rates and higher vendor settlements in 2025, as well as the absence of expenses from our cybersecurity business that was contributed to a new joint venture, LevelBlue, in the second quarter of 2024.

- Operating income was $5.8 billion, essentially consistent with the year-ago quarter. When adjusting for certain items, adjusted operating income* was $6.4 billion versus $6.0 billion in the year-ago quarter.

- Equity in net income of affiliates was $1.4 billion, primarily from the DIRECTV investment, versus $0.3 billion in the year-ago quarter, reflecting cash distributions received by AT&T in excess of the carrying amount of our investment in DIRECTV.

- Net income was $4.7 billion versus $3.8 billion in the year-ago quarter.

- Net income attributable to common stock was $4.4 billion versus $3.4 billion in the year-ago quarter. Earnings per diluted common share was $0.61 versus $0.47 in the year-ago quarter. Adjusting for $(0.10) which removes equity in net income of DIRECTV and excludes restructuring costs and other items, adjusted earnings per diluted common share* was $0.51 versus $0.48 in the year-ago quarter.

- Adjusted EBITDA* was $11.5 billion versus $11.0 billion in the year-ago quarter.

- Cash from operating activities was $9.0 billion, versus $7.5 billion in the year-ago quarter, reflecting $1.4 billion cash flows related to DIRECTV, which included a $1.1 billion dividend, and operational growth.

- Capital expenditures were $4.3 billion versus $3.8 billion in the year-ago quarter. Capital investment* totaled $4.5 billion versus $4.6 billion in the year-ago quarter. Cash payments for vendor financing totaled $0.2 billion versus $0.8 billion in the year-ago quarter.

- Free cash flow,* which excludes cash flows from DIRECTV, was $3.1 billion versus $2.8 billion in the year-ago quarter.

- Total debt was $126.2 billion at the end of the first quarter, and net debt* was $119.1 billion.

Segment and Business Unit Results

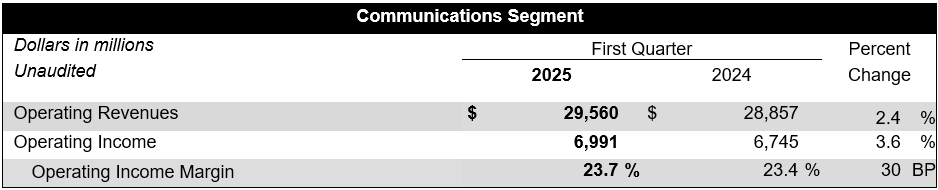

Communications segment revenues were $29.6 billion, up 2.4% year over year, with operating income up 3.6% year over year.

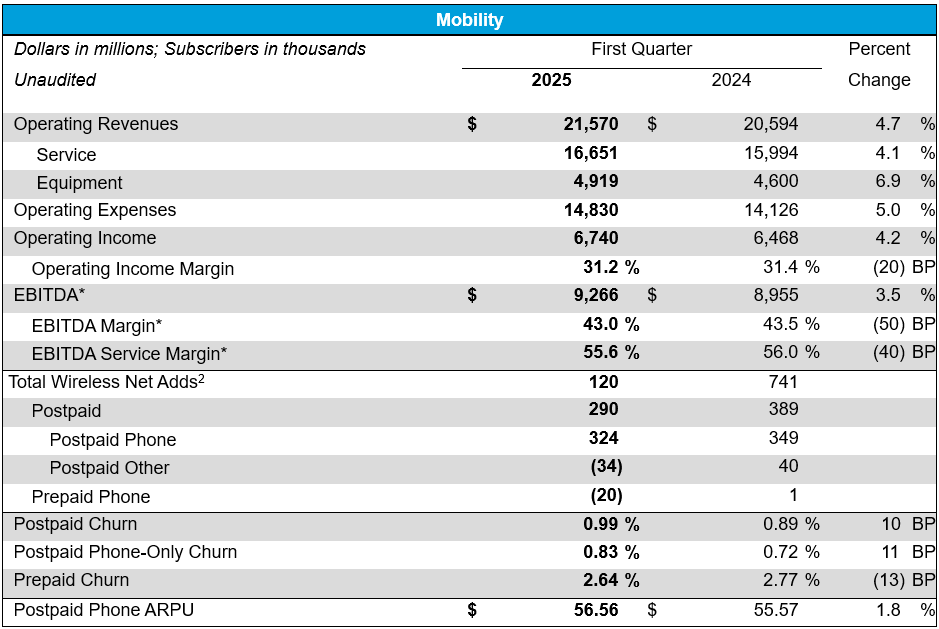

Mobility service revenue grew 4.1% year over year driving EBITDA* growth of 3.5%. Postpaid phone net adds were 324,000 with postpaid phone ARPU up 1.8% year over year.

Mobility revenues were up 4.7% year over year driven by service revenue growth of 4.1% from postpaid phone average revenue per subscriber (ARPU) growth and subscriber gains, as well as equipment revenue growth of 6.9% from higher wireless device sales volumes. Operating expenses were up 5.0% year over year due to higher equipment expenses from higher wireless sales volumes. This increase also reflects higher advertising costs due to the launch of a new campaign, higher promotion costs, higher network costs and increased depreciation expense. Operating income was $6.7 billion, up 4.2% year over year. EBITDA* was $9.3 billion, up $311 million year over year.

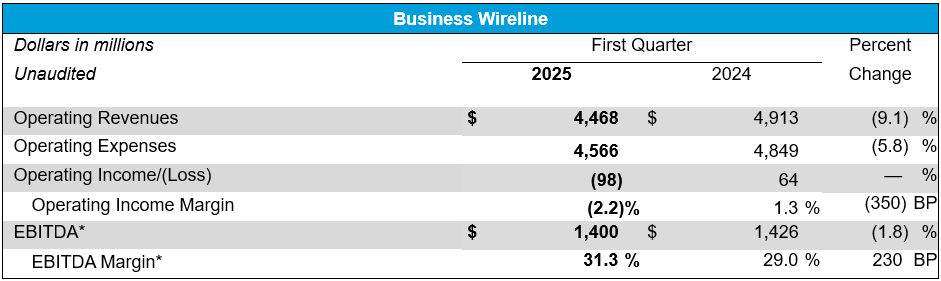

Business Wireline revenues declined year over year driven by continued secular pressures on legacy and other transitional services that were partially offset by growth in fiber and advanced connectivity services.

Business Wireline revenues were down 9.1% year over year, due to declines in legacy and other transitional services of 17.4%, partially offset by growth in fiber and advanced connectivity services of 4.5%. Revenue declines were also impacted by the absence of revenues from our cybersecurity business that was contributed to LevelBlue during the second quarter of 2024, and targeted pricing actions in legacy services. Operating expenses were down 5.8% year over year due to lower personnel costs associated with ongoing transformation initiatives, lower network access costs that included higher vendor settlements in 2025 and the contribution of our cybersecurity business, partially offset by higher depreciation expense due to ongoing investment for strategic initiatives such as fiber. Operating income was $(98) million versus $64 million in the prior-year quarter, and EBITDA* was $1.4 billion, slightly lower year over year.

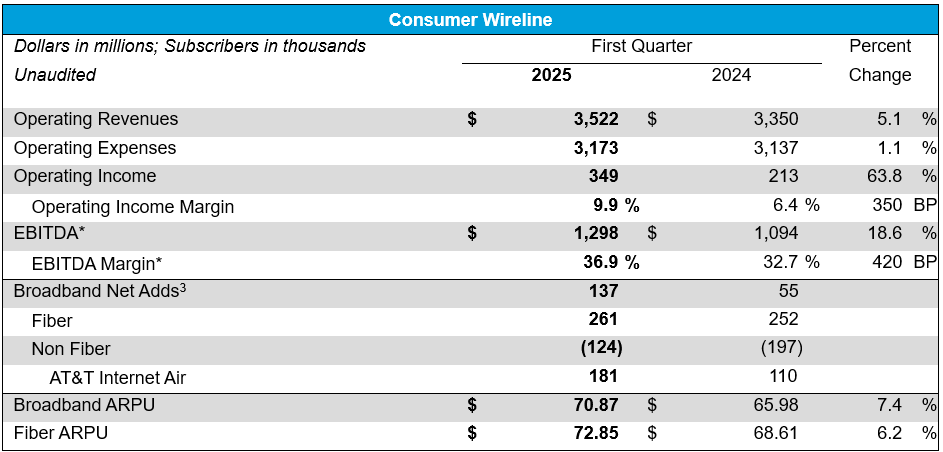

Consumer Wireline achieved strong broadband revenue driven by 19.0% fiber revenue growth. Consumer Wireline also delivered positive broadband net adds for the seventh consecutive quarter, driven by 261,000 AT&T Fiber net adds and 181,000 AT&T Internet Air net adds.

Consumer Wireline revenues were up 5.1% year over year driven by broadband revenue growth of 9.6% due to fiber revenue growth of 19.0%, partially offset by declines in legacy voice and data services and other services. Operating expenses were up 1.1% year over year, primarily due to higher depreciation expense driven by fiber investment, partially offset by lower customer support and network-related costs that include higher vendor settlements in 2025. Operating income was $349 million versus $213 million in the prior-year quarter, and EBITDA* was $1.3 billion, up $204 million year over year.

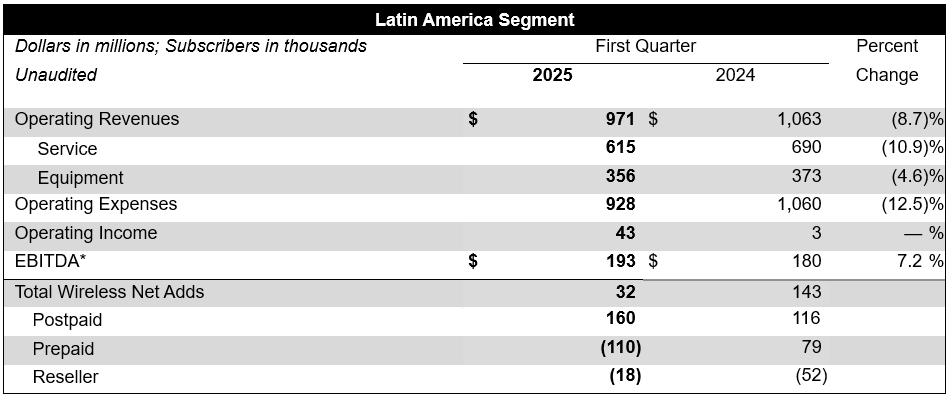

Latin America segment revenues were down 8.7% year over year, primarily due to unfavorable impacts of foreign exchange rates, partially offset by higher equipment sales, and subscriber and ARPU growth. Operating expenses were down 12.5% due to the favorable impacts of foreign exchange rates, partially offset by higher equipment and selling costs resulting from higher sales. Operating income was $43 million compared to $3 million in the year-ago quarter. EBITDA* was $193 million, compared to $180 million in the year-ago quarter.

PR Archives: Latest, By Company, By Date