- Quarterly revenues of EUR 166.3 million, up by 11.4% compared to year-ago quarter

- Pro forma EBIT at EUR 6.4 million (3.9% of revenues)

- Outlook fiscal year 2022: Revenues EUR 680 – 730 million; Pro forma EBIT 5.0% – 9.0% of revenues

ADVA (ISIN: DE0005103006, FSE: ADV), a leading provider of open networking solutions for the delivery of cloud and mobile services, reported final financial results for Q2 2022 ended on June 30, 2022. The results have been prepared in accordance with International Financial Reporting Standards (IFRS).

Q2 2022 IFRS financial results

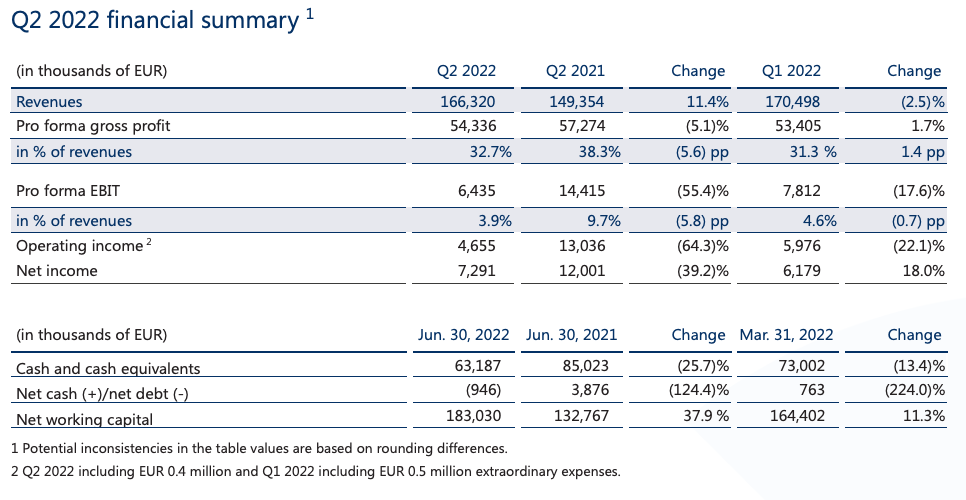

Revenues in Q2 2022 reached EUR 166.3 million, down by 2.5% from EUR 170.5 million in Q1 2022 and up by 11.4% compared to EUR 149.4 million in Q2 2021. The increase in revenues for Q2 2022 is predominantly driven by a growth in demand from network operators and internet content providers (ICPs). In addition, the stronger US dollar led to higher revenues in North America.

Pro forma gross profit in Q2 2022 increased by 1.7%, reaching EUR 54.3 million (32.7% of revenues) compared to EUR 53.4 million (31.3% of revenues) in Q1 2022 and decreased by 5.1% compared to EUR 57.3 million (38.3% of revenues) reported in Q2 2021. Gross profit was impacted by increased purchasing costs caused by the semiconductor crisis and a stronger US Dollar.

Pro forma EBIT for Q2 2022 was EUR 6.4 million (3.9% of revenues) and decreased by 17.6% compared to EUR 7.8 million (4.6% of revenues) reported in Q1 2022 and substantially declined by 55.4% from EUR 14.4 million (9.7% of revenues) in Q2 2021.

Operating income for Q2 2022 of EUR 4.7 million decreased by 22.1% from EUR 6.0 million reported for Q1 2022 and significantly decreased by 64.3% from EUR 13.0 million in Q2 2021. Operating income for Q2 2022 was impacted by extraordinary expenses in connection with the announced merger with Adtran amounting to EUR 0.4 million (Q1 2022 EUR 0.5 million and Q2 2021 EUR 0).

Net income reached EUR 7.3 million in Q2 2022, increased by 18.0% from EUR 6.2 million in Q1 2022, and considerably decreased by 39.2% from EUR 12.0 million in Q2 2021.

The company’s cash and cash equivalents totaled EUR 63.2 million, representing a decrease of EUR 9.8 million compared to EUR 73.0 million at the end of Q1 2022. Year-over-year cash and cash equivalents decreased by EUR 21.8 million from EUR 85.0 million at the end of Q2 2021. The company invested non-operating cash in measures to secure delivery.

Net debt at the end of Q2 2022 stood at EUR 0.9 million compared to a net cash position of EUR 0.8 million at the end of Q1 2022 and a net cash position of EUR 3.9 million at the end of Q2 2021.

At quarter-end, net working capital totaled EUR 183.0 million and increased by EUR 18.6 million compared to EUR 164.4 million at the end of Q1 2022 and increased significantly by EUR 50.3 million compared to EUR 132.8 million at the end of Q2 2021. The higher net working capital compared to the year-ago quarter is mainly attributable to increased inventory levels to secure the supply chain.

Our revenues in the first half of 2022 were at a record level.

Management commentary

“The recent months were very exciting for us as a company,” said Brian Protiva, CEO of ADVA. “We reached several important milestones on our journey of joining forces with Adtran and advanced our operational business. Our revenues in the first half of 2022 were at a record level, and our order books are nicely filled. We still see strong customer demand paired with a high level of complexity and costs in the areas of procurement, production and logistics. This environment will continue for the foreseeable future. Our teams work tirelessly on solutions to meet market demand, and we work closely with our customers every day to provide the best possible support for their network development. So far, we’ve mastered the challenges very well and look positively towards the remainder of the year.”

“In the past quarter, we again grew compared to the year-ago quarter. This underlines the positive market environment and the tailwind we are experiencing on the demand side,” said Uli Dopfer, CFO of ADVA. “However, in the second half of the year, we will also have to deal with the challenges resulting from increased procurement costs and stressed supply chains. Despite increased inventories, our liquidity is at a satisfying EUR 63 million. Against the background of a continued strong order intake and a strengthening dollar in combination with persistently higher costs in the supply chains, we have decided to adjust the outlook for the fiscal year accordingly, which we announced in an ad-hoc notification on July 15th. We are raising our revenue guidance to between EUR 680 and 730 million and reducing our pro forma EBIT margin guidance by one percentage point to between 5% and 9%.”

2022 financial outlook

For the fiscal year 2022, ADVA expects revenues to be in the range of EUR 680 million and 730 million and a pro forma EBIT of between 5.0% and 9.0% of revenues.

The company will publish its financial results for Q3 2022 on October 27, 2022.

Conference call details

ADVA will hold a conference call for analysts and investors today, July 28, 2022, to discuss the Q2 2022 results. The company’s CEO, Brian Protiva, CTO, Christoph Glingener, and CFO, Uli Dopfer, will host the call at 3:00 p.m. CEST (9:00 a.m. EDT). A question and answer session will follow management presentations.

A corresponding presentation is available on ADVA’s website:

https://www.adva.com/en/about-us/investors/financial-results/conference-calls

The complete half year report 2022 (January – June) is available as a PDF:

https://www.adva.com/en/about-us/investors/financial-results/financial-statements

A replay of the call will be available here:

https://www.adva.com/en/about-us/investors/financial-results/conference-calls

Forward-looking statements

The economic projections and forward-looking statements contained in this document relate to future facts. Such projections and forward-looking statements are subject to risks that cannot be foreseen and that are beyond the control of ADVA. ADVA is therefore not in a position to make any representation as to the accuracy of economic projections and forward-looking statements or their impact on the financial situation of ADVA or the market in the shares of ADVA.

Use of pro forma financial information

ADVA provides consolidated pro forma financial results in this press release solely as supplemental financial information to help investors and the financial community make meaningful comparisons of ADVA’s operating results from one financial period to another. ADVA believes that these pro forma consolidated financial results are helpful because they exclude non-cash charges related to the stock option programs and amortization and impairment of goodwill and acquisition-related intangible assets, which are not reflective of the company’s operating results for the period presented. Additionally, non-recurring expenses related to M&A and restructuring measures are not included. This pro forma information is not prepared in accordance with IFRS and should not be considered a substitute for the historical information presented in accordance with IFRS.

PR Archives: Latest, By Company, By Date