- Quarterly revenues up 8.9% year-over-year to EUR 144.5 million

- Pro forma operating income increased significantly to EUR 12.9 million (8.9% of revenues)

- Outlook fiscal year 2021: Revenues EUR 580 – 610 million; Pro forma operating income 6.0% – 10.0% of revenues

ADVA (ISIN: DE0005103006), a leading provider of open networking solutions for the delivery of cloud and mobile services, reported record financial results for Q1 2021 ended on March 31, 2021. The results have been prepared in accordance with International Financial Reporting Standards (IFRS).

Q1 2021 IFRS financial results

Q1 2021 IFRS financial results

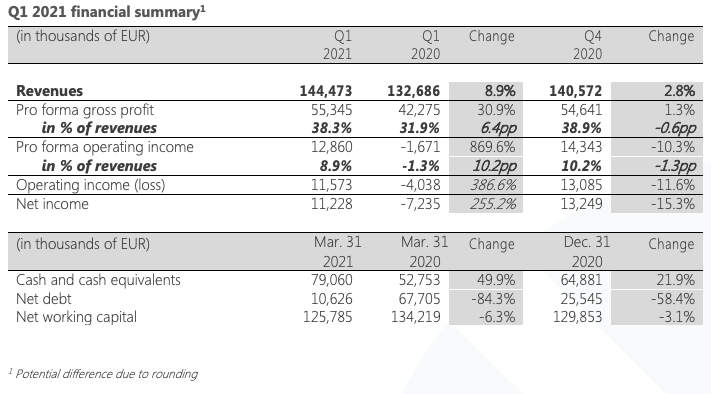

Revenues in Q1 2021 reached EUR 144.5 million, up by 2.8% from EUR 140.6 million in Q4 2020, also up by 8.9% compared to EUR 132.7 million in the same year-ago period, and are within the guidance corridor of between EUR 143 million and EUR 148 million. This success was particularly due to high order volume from network operators as well as private companies and governments.

Pro forma gross profit in Q1 2021 increased by 1.3%, reaching EUR 55.3 million (38.3% of revenues) compared to EUR 54.6 million (38.9% of revenues) in Q4 2020 and increased significantly by 30.9% compared to EUR 42.3 million reported in the year-ago quarter. Orders for network synchronization technology again developed positively in Q1. In addition, the customer mix contributed positively to the margin increase in the past quarter.

Pro forma operating income for Q1 2021 was EUR 12.9 million (8.9% of revenues) and decreased by 10.3% compared to EUR 14.3 million (10.2% of revenues) reported in Q4 2020. Compared to the year-ago quarter, pro forma operating income improved significantly by 869.6% from a loss of EUR 1.7 million (-1.3% of revenues). Hence the pro forma operating margin was at the top end of the guidance corridor of 7% to 9%. In addition to the higher gross profit, this substantial margin improvement is mainly due to improved operational expenditures.

Operating income for Q1 2021 of EUR 11.6 million decreased by 11.6% from EUR 13.1 million reported for Q4 2020 and significantly increased by 386.6% from a loss of EUR 4.0 million in the same year-ago quarter.

Net income reached EUR 11.2 million in Q1 2021, down by 15.3% from EUR 13.2 million in Q4 2020, and significantly up by 255.2% from a loss of EUR 7.2 million in Q1 2020.

The company’s cash and cash equivalents totaled EUR 79.1 million, representing an increase of EUR 14.2 million compared to EUR 64.9 million at the end of Q4 2020. Year-over-year cash and cash equivalents substantially increased by EUR 26.3 million from EUR 52.7 million at the end of Q1 2020. The higher cash balance is mainly the result of the improved profitability and lower capital expenditures, particularly compared to the prior-year quarter.

Consequently, net debt in Q1 2021 strongly decreased by EUR 14.9 million to EUR 10.6 million from EUR 25.5 million at the end of Q4 2020 and improved significantly by EUR 57.1 million compared to Q1 2020 (EUR 67.7 million).

Net working capital at quarter-end was EUR 125.8 million and decreased by EUR 4.1 million compared to EUR 129.9 million at the end of Q4 2020.

Today we report the best Q1 in our long history as a publicly listed company.

Management commentary

“Today we report the best Q1 in our long history as a publicly listed company. We’ve never posted higher revenues in the first quarter of a financial year, and we’ve never achieved higher profitability, generated more cash, or recorded a better order intake,” commented Brian Protiva, CEO, ADVA. “The speed of digitization in many countries has increased noticeably and we are seeing very good demand from all of our customer groups. At the same time, we are making good progress with the transformation of our business. Focus on growth markets with a higher proportion of software and services as well as more verticalization will bring our pro forma EBIT to around 10% of revenues.”

“Our transformation strategy combined with strict cost control showed the expected effects and have opened the door to sustainably higher margin potential. Net income of EUR 11.2 million is already over 50% of the result generated in 2020. With that, we have made an excellent start to the new financial year,” said Uli Dopfer, CFO, ADVA. “We were able to further increase cash and reduce net debt to EUR 10.6 million. This further underlines our strong financial position.”

Financial outlook 2021

For the fiscal year 2021, ADVA expects revenues to be in the range of EUR 580 million and EUR 610 million and a pro forma operating income of between 6.0% and 10.0% of revenues.

The company will publish its financial results for Q2 2021 on July 22, 2021.

Conference call details

ADVA will hold a conference call for analysts and investors today, April 22, 2021, to discuss the Q1 2021 results. The company’s CEO, Brian Protiva, and CFO, Uli Dopfer, will host the call at 3:00 p.m. CEST (9:00 a.m. EDT). A question and answer session will follow management presentations.

A corresponding presentation is available on ADVA’s website:

https://www.adva.com/en/about-us/investors/financial-results/conference-calls

The complete quarterly statement 3M 2021 (January – March) is available as a PDF:

https://www.adva.com/en/about-us/investors/financial-results/financial-statements

A replay of the call will be available here:

https://www.adva.com/en/about-us/investors/financial-results/conference-calls

Forward-looking statements

The economic projections and forward-looking statements contained in this document relate to future facts. Such projections and forward-looking statements are subject to risks that cannot be foreseen and that are beyond the control of ADVA. ADVA is therefore not in a position to make any representation as to the accuracy of economic projections and forward-looking statements or their impact on the financial situation of ADVA or the market in the shares of ADVA.

Use of pro forma financial information

ADVA provides consolidated pro forma financial results in this press release solely as supplemental financial information to help investors and the financial community make meaningful comparisons of ADVA’s operating results from one financial period to another. ADVA believes that these pro forma consolidated financial results are helpful because they exclude non-cash charges related to the stock option programs and amortization and impairment of goodwill and acquisition-related intangible assets, which are not reflective of the company’s operating results for the period presented. Additionally, expenses related to restructuring measures are not included. This pro forma information is not prepared in accordance with IFRS and should not be considered a substitute for the historical information presented in accordance with IFRS.

PR Archives: Latest, By Company, By Date