- Creates diversified telecommunications infrastructure company with assets across satellite, spectrum, fiber and related technologies

- Forms portfolio of assets that supports the needs of next-generation networks including connectivity everywhere, dense small cell deployments, dedicated licensed spectrum and deep fiber footprint

- Combined entity expected to have a strong balance sheet with low leverage, significantly reducing the need for future capital raises and creating long-term value in a tax efficient manner through the use of Globalstar’s NOLs

- Company to conduct rights offering for minority shareholders following the closing on the merger

COVINGTON, La.–(BUSINESS WIRE)–Globalstar, Inc. (NYSE American: GSAT) today announced it has signed a merger agreement with Thermo Acquisitions, Inc. pursuant to which the following assets will be combined with Globalstar: metro fiber provider FiberLight, LLC (FiberLight), 15.5 million shares of common stock of CenturyLink, Inc. (NYSE: CTL) (CenturyLink), $100 million of cash and minority investments in complementary businesses and assets of $25 million in exchange for Globalstar common stock valued at approximately $1.65 billion, subject to adjustments. Thermo Acquisition, Inc. is controlled by Jay Monroe, Executive Chairman of the Board of Directors and Chief Executive Officer of Globalstar. At closing the parent company will be renamed Thermo Companies, Inc., and its stock will continue to trade publicly. The transaction has been unanimously recommended by the Special Committee of the Board of Directors of Globalstar, consisting entirely of independent directors, and unanimously approved by the full Board of Directors. The merger is expected to close in the third quarter of 2018.

Jay Monroe, Executive Chairman of the Board of Directors and Chief Executive Officer of Globalstar and founder and controlling shareholder of Thermo Capital Partners and its affiliates (Thermo), said:

“This transaction brings together strategic assets that are critical to the complex needs of next-generation networks, allowing service providers to deliver the sophisticated services their customers increasingly expect. The combined entity is uniquely positioned to meet a broad range of customer requirements, from low latency and high capacity networks, to consistent connectivity across large geographical areas. Long-term shareholders should benefit significantly from the combined entity’s strong balance sheet and recurring revenue from the portfolio of satellites, spectrum, fiber infrastructure and other related assets.”

The combined company will hold a unique set of assets including Globalstar’s world-wide satellite business with 2017 Adjusted EBITDA of approximately $32 million and projected pro forma net debt outstanding of approximately $380 million at closing; a spectrum management company facilitating transactions related to Globalstar’s U.S. and international terrestrial spectrum; FiberLight, a metro fiber provider serving 40 of the top 50 U.S. bandwidth providers across approximately 14,000 route miles with 2017 Adjusted EBITDA of approximately $67 million based on unaudited results and approximately $200 million of net debt at closing; and Thermo Investments, an investment management company with initial investments in CenturyLink stock valued today at approximately $275 million, which is expected to provide annual dividends of approximately $33.5 million, minority investments in Pivotal Commware and Orion Labs, plus $100 million of investable cash. Looking forward to the full year 2019, management expects Adjusted EBITDA1 of the combined entity to be in excess of $165 million and combined net debt2 at December 31, 2019 of less than $200 million.

Diverse Portfolio of Assets

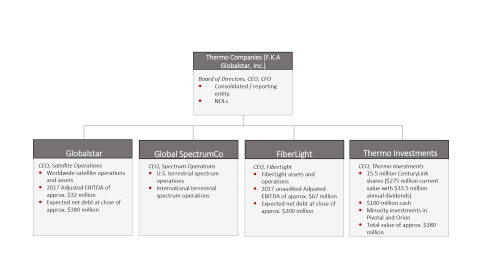

The merger will organize the pro forma company into four principal operating subsidiaries under the name Thermo Companies, Inc. (Thermo Companies) as the public company. These operations include Globalstar, FiberLight, Global SpectrumCo and Thermo Investments; refer to associated chart for further details.

Based in Alpharetta, Georgia, FiberLight operates a unique fiber optic asset base providing dark and lit fiber services over its footprint of approximately 14,000 route miles across Texas, the Southeast, Mid-Atlantic and Bay Area providing predominantly metropolitan high-bandwidth solutions to enterprise and wireless carriers. The combination of network assets, attractive markets, quality leadership and disciplined capital deployment has resulted in a growing revenue base across an expanding footprint. Thermo originally invested in the fiber industry in 2002 with Xspedius Management Co.’s (Xspedius) acquisition of e.spire Communications and spun FiberLight out of Xspedius in 2005. Xspedius was acquired by Time Warner Telecom in 2006, which subsequently merged with Level 3 Communications in 2014, and then merged with CenturyLink last year. Over the past decade, FiberLight grew from a small operator of individual dark fiber markets to a significant market participant in the fiber industry with a Tier 1 customer base represented by some of the largest technology companies, cable companies and wireless carriers in the U.S.

CenturyLink completed its merger with Level 3 Communications in November 2017 creating a global leader in network services with 450,000 route miles of fiber, over 100,000 buildings on-net, and a management team focused on driving significant free cash flow per share and maintaining its dividend. Thermo Investments will hold 15.5 million shares in CenturyLink with a current value of $275 million and expected annual dividends of $33.5 million. Thermo Investments also will manage approximately $100 million in cash for future investments and will deploy this cash in strategies consistent with Thermo’s history of acquiring asset intensive businesses at early stages of transformational industry developments. These investments are expected to include control and non-control opportunities across capital structures with cash flow reinvested within Thermo Companies or deployed into new opportunities. Thermo also will contribute $25 million of other assets including minority investments in Pivotal Commware and Orion Labs and the real estate comprising Globalstar’s new headquarters building, all contributed at cost.

Financial Highlights

The merger is expected to create a fundamentally stronger company with significantly reduced leverage and diversified holdings serving the global telecommunications industry. The anticipated combined Adjusted EBITDA of pro forma Thermo Companies will be at least 4x standalone Globalstar. The pro forma cash flow of the combined company will be derived from five principal sources including (i) satellite operations, (ii) leasing or other monetization revenue from global spectrum, (iii) FiberLight operations, (iv) dividend income and (v) other Thermo Investments’ returns. The pro forma company is expected to benefit from Globalstar’s $1.7 billion U.S. net operating losses allowing growth in a tax efficient manner. By materially improving the combined company’s liquidity position, Globalstar believes the merger will best position the company for monetizing its 2.4 GHz terrestrial spectrum in addition to maximizing the global opportunities to participate in terrestrial deployments of all four of its spectrum bands. Globalstar is currently seeking standardization approval of its 2.4 GHz spectrum which is proceeding under a “3GPP working item” with expected approval in the next year.

Globalstar has reached an agreement in principle with its lenders on an amendment of its BPIFAE (formerly known as COFACE) senior debt facility, which is subject in all respects to lender and BPIFAE committee approvals as well as satisfactory final due diligence. Additionally, final amended terms will be subject to documentation in a binding agreement to be agreed among the parties that will be effective concurrent with the closing of the merger. The agreement in principle provides for annual deferrals of principal amortization up to $30 million and a fixed margin of 3.25% over 6 month LIBOR, both subject to liquidity tests performed over time. Additionally, the financial covenants and certain other terms are expected to be amended. FiberLight is seeking an amendment to its $255 million senior debt facility with CoBank, including additional financing capacity to fulfill its current project backlog. FiberLight is requesting that the refinanced credit facility retain its favorable 1% annual principal amortization. Any amended terms are subject in all respects to the approval of CoBank.

Anticipated Rights Offering for Minority Shareholders

Upon completion of the merger, Thermo Companies expects to initiate a rights offering of up to $100 million for minority shareholders. The rights offering would be consummated approximately 45 days following closing, is expected to be available to holders of record on the date of closing and will include an over-subscription privilege allowing for the subscription of additional shares with allotments otherwise on a pro rata basis.

Structure & Approvals

As a result of the merger, Globalstar Chairman and CEO Jay Monroe will increase his beneficial ownership in the pro forma company from a fully diluted ownership of approximately 58% today to between 83% and 87% at closing. The final ownership level is variable based on the 20-day volume weighted average share price upon close. The issuance price is subject to a collar set at 80% and 120% of Globalstar’s 20-day volume weighted average share price on April 24, 2018, the date the Merger Agreement was executed. The Merger Agreement has been recommended by Globalstar’s Special Committee of Independent Directors, who were represented by independent counsel and which retained Moelis & Company (Moelis) to serve as its exclusive financial advisor. Moelis has rendered an opinion to the Special Committee that as of the date of the Merger Agreement, subject to factors and assumptions set forth in the opinion, that the value to be paid is fair to minority stockholders of Globalstar from a financial point of view.

Principal Merger Agreement Terms

The merger consideration will consist of shares of Globalstar common stock with a value of approximately $1.65 billion, subject to adjustment based on changes to the value of CenturyLink’s share price between signing and close, FiberLight’s last twelve months EBITDA at close and FiberLight’s net debt position at close. Completion of the transaction is subject to the satisfaction of the conditions set forth in the Merger Agreement, including approval by the lenders of Globalstar and FiberLight and by Globalstar’s stockholders. Accordingly, there can be no assurance that this transaction will be consummated.

Pursuant to the terms of the Merger Agreement, Thermo and its affiliates who own Globalstar common stock have signed a voting agreement pursuant to which it and its affiliates have granted a proxy and/or agreed to vote in favor of the transaction at any meeting of stockholders. Globalstar expects to seek approval from its stockholders during the second quarter of 2018, subject to Securities and Exchange Commission (SEC) review of the prospectus/proxy statement to be filed by Globalstar for the proposed transaction.

Additional Information about the Proposed Merger and Where to Find It

In connection with the proposed transaction, Globalstar will file materials with the SEC, including a joint proxy statement/prospectus. Investors are urged to read these materials when they become available because they will contain important information about Globalstar, FiberLight and the proposed transaction. The proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by Globalstar with the SEC, may be obtained free of charge at the SEC’s web site at www.sec.gov. In addition, investors may obtain free copies of the documents filed with the SEC by Globalstar by directing a written request to: Globalstar, Inc., 300 Holiday Square Blvd., Covington, LA 70433 Attention: Investor Relations. Investors are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed transaction.

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants in the Solicitation

Globalstar and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Globalstar in connection with the proposed transaction. Information regarding the special interests of these directors and executive officers in the proposed transaction will be included in the proxy statement/prospectus referred to above. Additional information regarding the directors and executive officers of Globalstar is also included in its Annual Report on Form 10-K for the year ended December 31, 2017 and the proxy statement for Globalstar’s 2018 Annual Meeting of Stockholders. These documents are available free of charge at the SEC’s web site (www.sec.gov) and from Investor Relations at Globalstar at the address described above.

Forward Looking Statement Safe Harbor

This press release contains certain statements that are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Forward-looking statements, such as the structure, timing and completion of the proposed transaction, future financial and operating results, benefits and synergies of the proposed transaction, future opportunities for the combined company, the ability of the parties to satisfy the conditions to closing contained in the Merger Agreement, the complete of the 2017 FiberLight audit and the results thereof, and any adjustments to the merger consideration based on the last twelve month Adjusted EBITDA of FiberLight and other statements contained in this release regarding matters that are not historical facts, involve predictions. Any forward-looking statements made in this press release are believed to be accurate as of the date made and are not guarantees of future performance. Actual results or developments may differ materially from the expectations expressed or implied in the forward-looking statements, and we undertake no obligation to update any such statements. These risks, as well as other risks associated with the transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the Registration Statement on Form S-4 that will be filed with the SEC in connection with the transaction. Additional risks and uncertainties are identified and discussed in Globalstar’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

About Thermo

Thermo was founded in 1984 to develop power plants and natural gas assets. The cash flow generated from these early energy assets was deployed across several industries with uncorrelated financial drivers including real estate, aircraft leasing, industrials, financial services and telecom. Over the past 30 years, a variety of investment strategies have been utilized across capital structures, ranging from internally developed start-up businesses to late-stage investments. Thermo’s partners are deeply involved in day-to-day management for primary holdings and have proven start-up, turnaround and late-stage growth experience across industries. Thermo typically seeks investments in industries undergoing periods of transition that may require a longer investment horizon than is acceptable to other investors. For more information, visit www.thermoco.com.

About Globalstar, Inc.

Globalstar is a leading provider of mobile satellite voice and data services. Customers around the world in industries such as government, emergency management, marine, logging, oil & gas and outdoor recreation rely on Globalstar to conduct business smarter and faster, maintain peace of mind and access emergency personnel. Globalstar data solutions are ideal for various asset and personal tracking, data monitoring, M2M and IoT applications. The Company’s products include mobile and fixed satellite telephones, the innovative Sat-Fi satellite hotspot, Simplex and Duplex satellite data modems, tracking devices and flexible service packages. For more information, visit www.globalstar.com.

About FiberLight, LLC

FiberLight provides mission critical high bandwidth networks customized for clients’ specific requirements. FiberLight owns and operates deep fiber networks in over 30 metropolitan areas in the U.S. with a concentration in Texas, the Southeast, the Washington DC corridor, Mid-Atlantic markets and Bay Area. The growing network currently consists of approximately 14,000 route miles and 26,000 backbone access points. Customers include domestic and international telecom companies, wireless, wireline, cable and cloud providers as well as key players across enterprise, government and education representing 40 of the top 50 bandwidth providers in the United States. For more information, visit www.fiberlight.com.

|

___________________ |

| 1 Adjusted EBITDA defined as Globalstar Adjusted EBITDA, plus FiberLight Adjusted EBITDA, plus dividend income from 15.5 million CTL shares of $0.54 per share per quarter plus investment income from Thermo Investments. |

| 2 Includes projected BPIFAE facility balance at December 31, 2019 plus CoBank facility balance, less cash and equivalents of the combined entity including 15.5 million CTL shares assumed at a constant value per share. |

Contacts

Globalstar, Inc.

Samantha DeCastro

InvestorRelations@globalstar.com

Deprecated: Function link_pages is deprecated since version 2.1.0! Use wp_link_pages() instead. in /home/powellrw/public_html/community.telecomramblings.com/public/wp-includes/functions.php on line 6131

PR Archives: Latest, By Company, By Date